For both buyers and sellers, Vendor Take Back Mortgages (sometimes called a VTB mortgage) can be a useful option to consider for residential or commercial property. In this post, we cover off the key points you should be aware of about Vendor Take Back Mortgages.

What is a Vendor Take Back Mortgage?

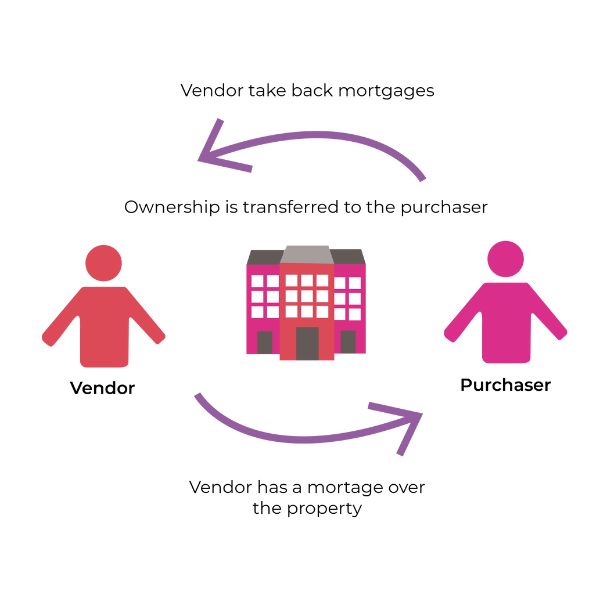

The vendor, or seller of the property, loans a sum of money to the buyer to enable them to buy the property. The vendor’s loan is referred to as a Vendor Take Back Mortgage.

The diagram above shows an example of a vendor take back mortgage. The vendor is selling a property for $500,000 and the purchaser has agreed to buy it. The vendor agrees to lend the purchaser $200,000 towards the purchase and takes a vendor take back mortgage over the property for $200,000. The purchaser makes repayments on the mortgage and if they default, then the vendor may be able to exercise their right to foreclose and sell the property to recover their money.

When might a seller consider a Vendor Take Back Mortgage?

Where a seller is having problems selling their home or property, they might consider a Vendor Take Back Mortgage. In this situation, the seller acts as the lender of funds to the buyer of the property. The buyer will generally pay a higher interest rate than normal.

Importantly, for the property to be eligible for a Vendor Take Back Mortgage, the seller must not have a current mortgage on the property.

When might a buyer consider a Vendor Take Back Mortgage?

A buyer who is particularly keen to secure a property might consider a Vendor Take Back Mortgage. For example, the buyer might be limited as to how much they can borrow from a traditional lender, and want to extend their borrowing capacity. Or the buyer might be affected by poor credit, or not have enough money for the down payment.

A Vendor Take Back Mortgage normally attracts a higher interest rate compared to a traditional mortgage.

What’s the difference between a Vendor Take Back Mortgage and a traditional mortgage?

Traditional mortgages come from a bank or other lending institution. The mortgage is secured by the real estate, and will be repaid over a period of time – say 10–30 years.

With a Vendor Take Back Mortgage, the lender is the owner of the property. The money loaned is secured by the property. Because of the additional risk taken on by the vendor, the interest rate paid by the buyer will tend to be higher than a traditional mortgage. In the event of foreclosure, the vendor can evict the occupant (normally the buyer), and re-sell the property. In some situations, there might be both a traditional mortgage alongside a vendor take back mortgage.

Whether you are the buyer or seller considering a Vendor Take Back Mortgage, you should ensure you discuss your arrangements with a real estate lawyer to ensure your interests are protected.

We offer a free initial consultation so contact us today.